When Can Dealers Charge Titling Service Fee Ohio? (2026 Guide)

Quick Answer

When can dealers charge titling service fee Ohio? The answer depends on whether the dealership performs qualifying registration services or uses a dealer-paid electronic titling workflow as part of the transaction.

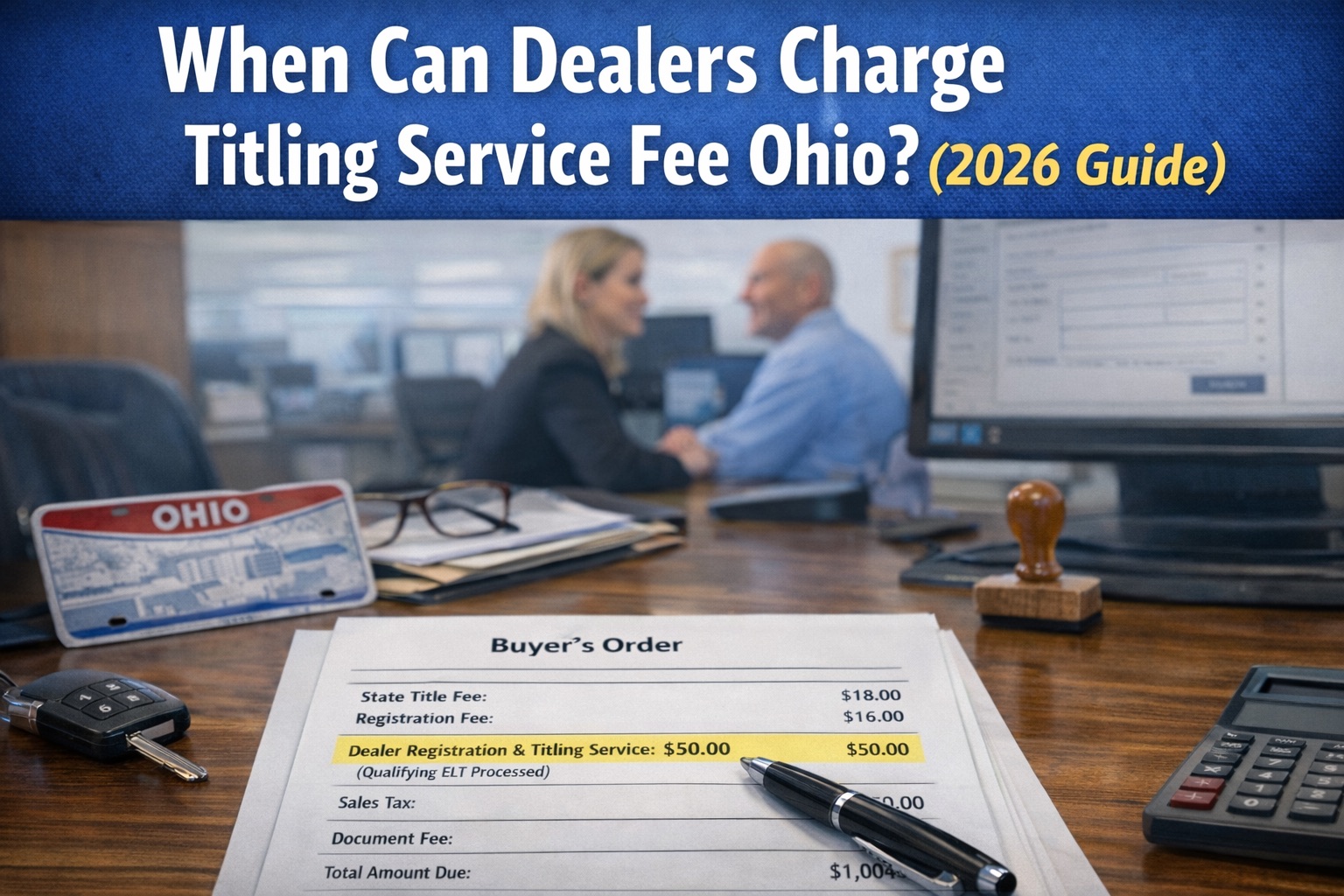

The $50 Registration & Titling Service Fee may cover registration services, titling services, or both, but it may only be charged once per vehicle transaction.

When Can Dealers Charge Titling Service Fee Ohio?

Ohio dealerships are trying to answer a practical question ahead of the rule rollout: when can dealers charge a titling service fee in Ohio? The answer is not about staff effort — it is about whether the dealership performed specific qualifying registration or electronic titling services as part of the transaction workflow.

This fee is tied to defined services, not general deal handling.

The fee is optional, must be separately itemized, and requires use of a paid third-party electronic titling provider if applied to titling services.

For full rule context, see:

Ohio Registration & Titling Service Fee

Eligibility Is About Service Performed — Not Effort Spent

The rule centers on value-added services performed on the customer’s behalf.

Dealerships cannot justify the fee based on:

• Time spent on paperwork

• Internal administrative handling

• Standard deal processing

Eligibility must connect to a registration submission or electronic titling workflow.

If Ohio’s free electronic titling tools (Title Gateway or ETS) are used, a titling service fee may not be charged.

Qualifying vs Non-Qualifying Services

| Service Type | Qualifies for Fee | Examples of Qualifying Actions | Does Not Qualify |

|---|---|---|---|

| Dealer-Handled Registration | Yes | Plate or tag processing, submitting registration to BMV, handling registration steps for customer | Advising customer, preparing forms only |

| Dealer-Paid Electronic Titling | Yes | Using a dealer-paid electronic titling workflow as part of title submission | Using only free BMV tools |

| Combined Registration + Titling | Yes (one fee) | Registration handling plus dealer-paid electronic titling | Basic administrative steps |

| General Deal Processing | No | Paperwork prep, internal coordination | Staff time alone |

Even when both registration and titling services are performed, only one service fee may be charged per vehicle.

One Vehicle Means One Fee

Even if both registration and electronic titling services occur, only one fee per vehicle may be charged.

Multiple qualifying steps do not create multiple fees.

The $50 fee is subject to Ohio sales tax and must appear as its own line item separate from government charges.

Documentation Confirms Eligibility

When the fee is applied, the dealership should be able to show:

• What service was performed

• When it occurred

• Which workflow or system was used

Dealerships that standardize workflows reduce risk.

Mailing or courier costs (USPS, FedEx, UPS, etc.) may be charged in addition to the service fee, but must be listed as a separate line item.

See how Ohio dealership registration software supports process tracking and documentation.

Eligibility vs Itemization

Qualifying service determines whether the fee may be charged.

Itemization determines how it appears on the deal.

The service fee must be clearly disclosed on buyer’s orders, lease orders, and installment sales contracts. Registration services require optionality language unless required by a lender or lessor. Titling services require written disclosure of the fee but do not require optionality wording.

For audit-safe presentation, review:

How to Itemize Ohio Registration & Titling Fees Without Failing an Audit

For prohibited scenarios, see:

What Dealers Can’t Do With Ohio’s $50 Registration & Titling Service Fee

Common Eligibility Mistakes

| Situation | Why It’s Risky |

|---|---|

| Fee added to every deal | Suggests automatic application |

| Fee applied when only free tools used | No qualifying service |

| No documentation of workflow | Weak defense in disputes |

| Confusion between doc fee and service fee | Misclassification risk |

The Risk of Eligibility Drift

Over time, variation appears between:

• F&I

• Title office

• Locations

Without defined standards, eligibility decisions become inconsistent — and patterns of inconsistency create exposure.

Dealerships that define qualifying workflows maintain control.

This eligibility information fits into the complete Ohio Registration & Titling Service Fee compliance guide for dealerships.

Frequently Asked Questions

When can a dealership charge a titling service fee in Ohio?

Dealerships may charge the fee only when they perform qualifying registration services or use a dealer-paid electronic titling workflow. The fee may cover registration services, titling services, or both, but may only be charged once per vehicle transaction. Administrative handling alone does not qualify.

Can the fee be charged if only paperwork is prepared?

No. Preparation alone is not a qualifying service.

Does using electronic titling always qualify?

Eligibility depends on the workflow and whether dealer-paid services are involved. Eligibility requires use of a dealer-paid electronic titling workflow. Use of Ohio’s free electronic titling tools does not allow charging the fee.

Can both registration and titling create two fees?

No. Only one fee per vehicle is allowed.

What if documentation is missing?

Eligibility becomes difficult to defend.

Is the Registration & Titling Service Fee taxable?

Yes. The service fee is subject to Ohio sales tax and must be itemized separately from government fees.

Can mailing or courier costs be charged in addition to the $50 fee?

Yes. Mailing costs may be charged separately but must appear as their own line item.

Final Thought for Dealership Operators

The Registration & Titling Service Fee is tied to service performed, not effort assumed.

Dealerships that define qualifying workflows protect themselves. Those that apply the fee by habit introduce risk.

To see how qualifying services, itemization, and documentation align inside one compliant workflow:

Schedule your fast, no-pressure demo here:

Schedule Your EZ E Title Demo