How to Itemize Ohio Registration and Titling Fees Without Failing an Audit

Quick Answer

How should Ohio dealerships itemize the Registration & Titling Service Fee under the March 1, 2026 rule?

As a separate dealer service line item (up to $50), clearly labeled, distinct from BMV/state fees, applied only when qualifying services are performed, limited to one fee per vehicle, and supported by documentation showing the workflow and service provided.

The $50 Registration & Titling Service Fee may cover registration services, titling services, or both, but it may only be charged once per vehicle transaction.

Why Itemization — Not Eligibility — Is Where Audits Happen

Most dealerships focus on whether they can charge the fee.

Audits focus on how the fee appears on the deal.

Even when a dealership qualifies, improper itemization creates:

• Customer disputes

• Chargebacks

• Internal compliance failures

• Regulatory exposure

The Registration & Titling Service Fee is subject to Ohio sales tax and must always appear as its own dealer service line item.

For rule background, review the Ohio Registration & Titling Service Fee overview.

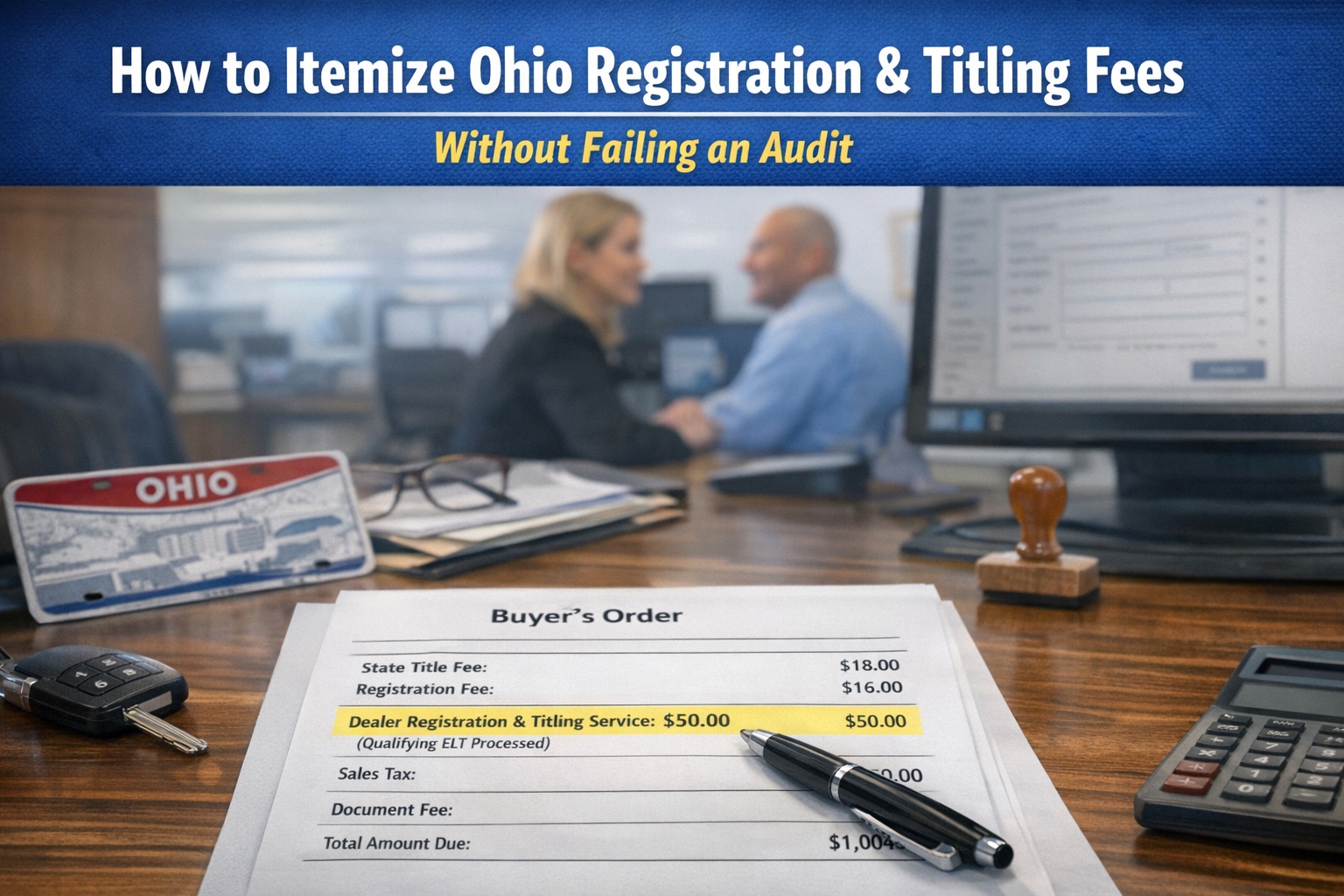

The Fee Must Be a Separate Dealer Service Line

The Registration & Titling Service Fee may not be bundled with:

• State title fees

• Registration fees

• Plate or tag charges

It represents a dealer-provided service, not a government charge.

Bundling removes transparency and creates dispute risk.

Mailing or courier costs (USPS, FedEx, UPS, etc.) may be charged in addition to the service fee, but must be listed as a separate line item.

Use a Standardized Label — Every Time

Inconsistent naming is a common audit trigger.

Avoid:

• “Title Fee”

• “Registration Fee”

• “State Processing”

Use one standardized label across all deals and stores that clearly identifies a dealer service.

For prohibited labeling and other risks, see:

👉 What Dealers Can’t Do With Ohio’s $50 Registration & Titling Service Fee

Apply the Fee Only When Services Qualify

The fee may be itemized only when the dealership:

• Performs qualifying registration services, and/or

• Uses a dealer-paid electronic titling workflow

It does not apply simply because staff time was spent.

Charging a titling service fee requires use of a paid third-party electronic titling provider. Use of Ohio BMV’s free electronic titling tools does not allow charging the fee.

One Vehicle Means One Fee

Even if both registration and electronic titling services occur, only one fee per vehicle may be itemized, up to $50.

Splitting the fee into multiple service-related charges tied to the same workflow is not compliant.

Even when both registration and titling services are performed, the dealership may still only itemize one service fee per vehicle.

Documentation Must Support the Line Item

Itemization without documentation creates exposure.

Dealerships should be able to show:

• What service was performed

• When it occurred

• Which workflow or system was used

Dealerships standardizing workflows reduce risk. The service fee must also be clearly disclosed in writing on buyer’s orders, lease orders, and installment sales contracts.

Registration services require optionality language unless required by a lender or lessor. Titling services require written disclosure of the fee but do not require optionality wording.

See how Ohio dealership registration software supports consistent documentation and reporting.

Audit-Safe vs Risky Itemization

| Issue | Why It Creates Risk | Audit-Safe Approach |

|---|---|---|

| Fee buried in “BMV Fees” | Lacks transparency | Separate dealer service line |

| Different labels by store or deal | Signals inconsistent process | One standardized label |

| Fee on every deal | Suggests automatic application | Apply only when qualifying |

| Multiple service fees per vehicle | Violates single-fee rule | One fee max per vehicle |

| No documentation | Weak defense in disputes | Workflow logs & audit trail |

How to Itemize Ohio Registration and Titling Fees (Operational Process)

-

Confirm qualifying service was performed

-

Apply one service fee (up to $50)

-

Use standardized dealer service label

-

Keep fee separate from state charges

-

Ensure documentation is tied to workflow

This turns the fee into a process outcome, not a pricing field.

For the complete rule framework and documentation requirements, review the Ohio Registration and Titling Service Fee guide.

The Real Risk: Process Drift

Over time, variation creeps in between:

• F&I

• Title office

• Locations

Without defined itemization standards, drift occurs — and audits catch patterns.

Dealerships that treat this as a controlled workflow maintain consistency.

Frequently Asked Questions

Can the fee be included in a doc fee?

No. It must be separately itemized. The service fee is subject to Ohio sales tax and must remain separate from doc fees and government charges.

Can labels vary by store?

Variation increases audit risk. Standardization is safer.

Does the fee apply to every deal?

No. Only when qualifying services are performed.

What if documentation is missing?

The fee becomes difficult to defend.

Can mailing or courier costs be charged in addition to the service fee?

Yes. Mailing or courier costs may be charged separately but must appear as their own line item.

Does use of Ohio’s free electronic titling tools allow the fee?

No. The fee requires use of a dealer-paid third-party electronic titling provider.

This itemization detail is part of the broader Ohio Registration & Titling Service Fee compliance framework, for the full rule guide, including eligibility and prohibited practices.

Final Thought for Dealership Operators

The Registration & Titling Service Fee is not a revenue line — it is a workflow result.

Dealerships that control labeling, itemization, and documentation protect themselves. Those that rely on habit introduce risk.

If your dealership wants to see how compliant itemization and documentation are handled inside a single workflow:

Schedule your fast, no-pressure demo here:

Schedule Your EZ E Title Demo